Background

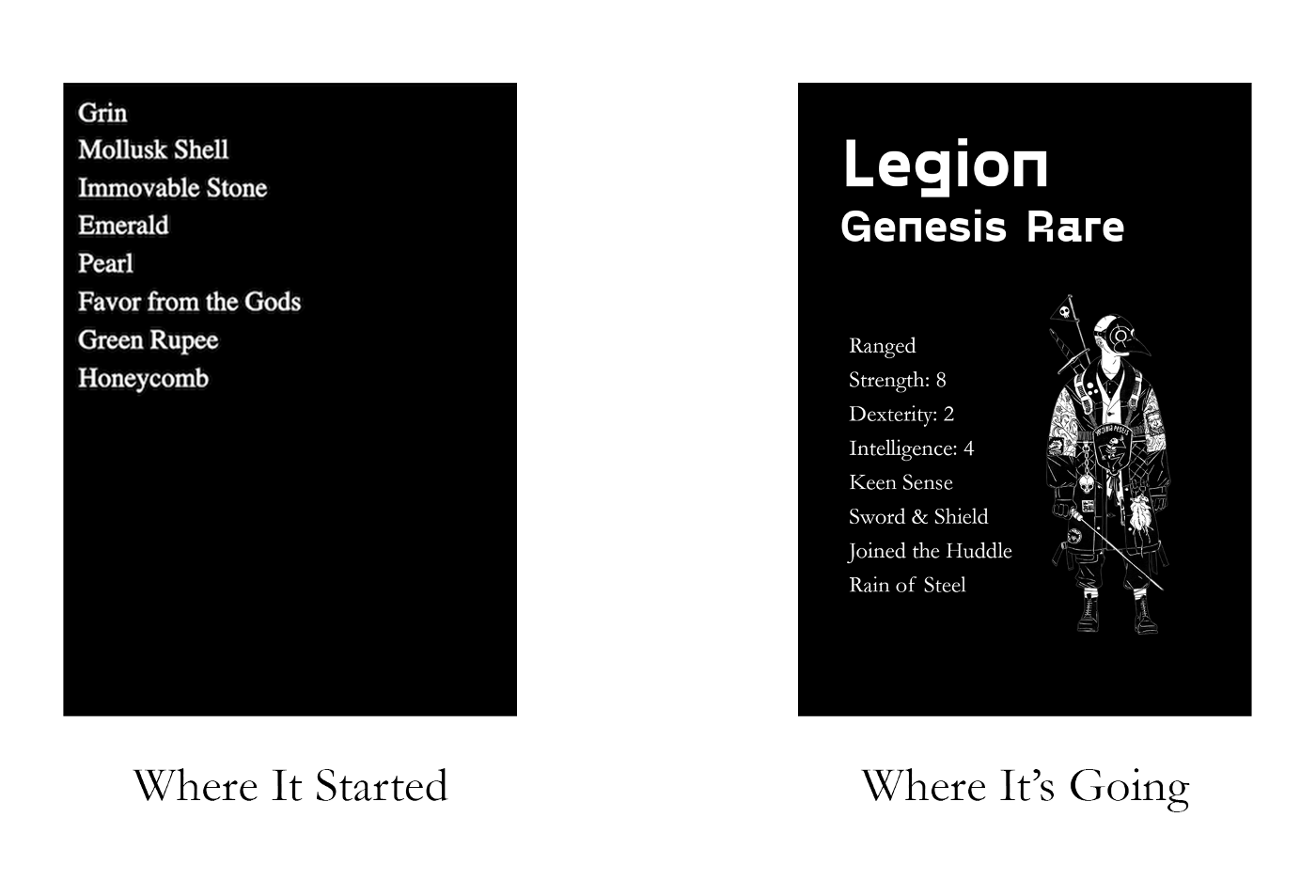

Less than a month ago, Treasure was launched as a derivative of the viral Loot project. Like Loot, Treasure cards are a list of eight randomly generated assets. Treasures are fictional monies native to Loot. The Treasure cards were intentionally vague to encourage users to use them for whatever purpose they wanted.

There were 10,000 original Treasure cards. The first 9,000 were free to mint. The other 1,000 were set aside for a Founder’s reserve. The founders decided after launch to distribute the remaining treasures to the Loot, xLoot, and AGLD communities, with 25% of the initial reserve being kept as protocol-controlled value. Distribution will occur when the project moves off Ethereum Layer 1 to its new home.

The Treasure project has iterated faster than any other Loot project. Within two weeks, it became possible to “unravel” your treasures and deposit them into yield protocols. The first such yield protocol is the Magic farm. Users can deposit Treasure, Loot, n, AGLD, or MAGIC-WETH LP tokens into the farm to earn MAGIC.

This weekend, we are creating two additional rewards within the farm. You will be able to stake your MAGIC tokens to earn rare legions cards. The LP incentives in the farm will be increasing as well.

After the initial farming period ends, Treasure will implement the next phase of the roadmap:

- Moving off L1 forever

- Upgrade of the existing cards, with new art and fixed bugs

- Launching a native marketplace for selling Treasure items, which uses MAGIC as the medium of exchange

- Consumable farming

MAGIC interacts with treasures to create mutually-reinforcing value. The long-term goal of the project is to create an array of liquid assets with loyal communities, on which game developers can build (the original Loot premise). This will be achieved through our special Proof of Work mechanism.

The Legions game, explained earlier, will be the first game to be built using the Treasure economy. We will be sharing more details soon about MAGIC’s exact mechanics within Legions.

Over time, we look forward to incorporating our dual-resource economy into other games as well, both through direct utilization and perhaps even using the liquidity of our economy to help bootstrap new game economies.

Proof of Work

In the next phase of farming, users will have to stake treasures and MAGIC to earn new items. The cost of farming is the price of the initial assets (the mining equipment) and the time it takes to perform these actions. An example mine would include:

- Stake MAGIC and diamonds to create drilling tools (one-time use consumables)

- Use drilling tools, donkeys, legions cards, and MAGIC to earn a legion upgrade

Like an actual mine, the Treasure mine would be finite. Whichever users perform the work extract the assets. The contents of the mine could be an unlimited number of things.

The goal is to create an economy of assets by which the rarest ones were earned through labor. An actual proof of work economy.

This mechanism is a vast improvement over traditional LP incentives. Most farms cater to mercenary farm and dumpers. We have opted for a model that will create slow, continuous growth in liquidity. The early days matter very little because the meat of the LP incentives will not be the token itself but rather the treasures. LPs are rewarded not just for providing liquidity but actually enhancing the quality of the ecosystem. Traditional liquidity mining has instant success and zero long-term efficacy. We are trying to create a long-term community, not instant liquidity.

Mining results in a virtuous cycle for MAGIC and the actual treasures. MAGIC is put into staking or LP positions indefinitely, leaving less of the token to go around. The token then gains “density” (i.e., a loyal community, established use cases), meaning it forms a foundation on which new types of derivatives and financial products can be built.

Users love rare items not only for their qualities, but also because of the effort it took to achieve them. This proof of work mechanism turns treasures from words onto a card into collectibles of provable value (cost of mining + time + collectors’ affinity for their treasure).

Moreover, as treasures gain financial value, they become valuable inputs for other DeFi products. Builders will compete to attract liquidity to their products. Protocols bid for users’ loyalty with higher yield and lower fees.

The virtuous cycle continues to compound, with demand for the inputs growing as the outputs become more sophisticated and valuable as well.

MAGIC Tokenomics

Farming will last for three more weeks. To mitigate the effect of whales, we opted for rewarding users with a consistent number of tokens per day. One AGLD token, for example, earns 0.1 MAGIC per day no matter the size of the pool. For every 10 tokens emitted, an additional token is minted for the team.

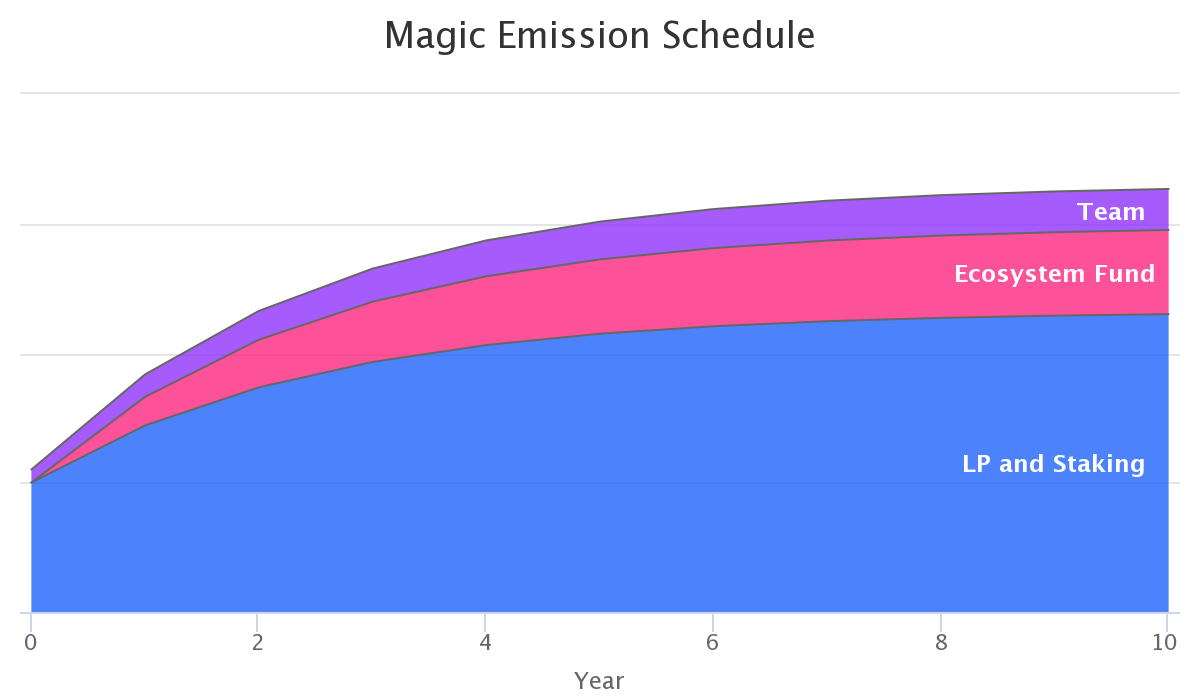

At the end of the farming period, one-third of the total supply of MAGIC will have been emitted.

The remaining two-thirds are for Treasure mines (LP incentives/staking), the ecosystem fund to grow MAGIC adoption, and team development.

MAGIC will have a “halvening” event similar to Bitcoin, but annually as opposed to every four years. Each year, a diminishing amount of MAGIC will be emitted as the token asymptotically approaches the max supply.

LP rewards will be distributed through proof of work mechanisms as well. You will be able to use MAGIC-WETH LP tokens to enter “Magic mines.” Similar to Curve, users who are willing to stake for the longest period will earn the most from these mines. Long-term participants in the protocol will also have the opportunity to earn special mining tools, like exceptionally rare drills. They can either sell these on the open market or save them for future use.

Over time, as the emission of MAGIC begins to taper off, we will continue using LP tokens as a key input for treasure farming. The incentive to provide liquidity will be not only swap fees, but also the opportunity to earn special consumables and perhaps new treasures as well.

Deflationary Mechanisms

MAGIC is designed to be increasingly scarce (emissions declining as complexity of the economy increases). The mines also function as token sinks that encourage staking, with longer-term staking receiving the most unique rewards.

We have also designed MAGIC to be deflationary by design. Certain mines will require users to burn MAGIC to extract the asset. Users will also be able to convert consumables into new kinds of treasures. This alchemy process (often referred to as “summoning” in other games) will require a burn of both consumables and MAGIC.

Growth of the native marketplace will also create more opportunities to reduce the circulating supply of MAGIC, through token sinks as well as a buy-and-burn model similar to BNB’s.

Conclusion

Through proof of work mining, the value of treasures and MAGIC is jointly established. MAGIC will become a liquid, deflationary, valuable asset for game building because of this virtuous cycle.

Follow us on Twitter: www.twitter.com/Treasure_DAO

Join us in the Discord: https://discord.gg/treasuredao